An Unbiased View of Paul B Insurance

The insurance policy company will certainly evaluate this record carefully when exploring your case. Take notes that cover all the information of the crash.

The time the mishap took place. The climate and also roadway conditions at the time of the accident.

He or she will: Look at as well as take photos of the damages to your auto. Go to the accident scene. Interview you, the other vehicle driver or chauffeurs involved, and also witnesses to the collision. Review the authorities report about the mishap. Analyze healthcare facility expenses, medical records, and also evidence of lost salaries associated with the accident with your authorization.

Getting My Paul B Insurance To Work

Determine fault in the crash. Offer a settlement quantity for your insurance claim based upon fault and also various other aspects. Go after the other chauffeur's insurance provider if she or he was at fault. You do not have to wait till this procedure has been finished to fix your automobile and also seek clinical treatment as long as you have coverage for those items.

Comprehending just how auto insurance works should be a priority for any new driver. Talk to your insurer if you already have insurance coverage yet desire to discover more about your plan. A representative can help you choose vehicle insurance that secures your individual properties from loss in an automobile mishap.

As a result, term life insurance policy often tends to be a lot more cost effective than long-term life insurance policy, with a fixed price that lasts for the entire term. As the initial term attracts to a close, you may have three choices for ongoing protection: Let the plan run out as well as replace it with a brand-new policy Restore the policy for one more term at a modified rate Convert your term life insurance policy to whole life insurance policy Not all term life insurance coverage policies are eco-friendly or convertible.

Unknown Facts About Paul B Insurance

:max_bytes(150000):strip_icc()/how-does-health-insurance-work-f7aa9125e51f4f6698b38789ff3929c3.png)

The free of charge life insurance coverage you get through your company is a type of team life insurance coverage. Group life insurance coverage may also be supplied by your church or another organization to which you belong.

Since credit scores life insurance coverage is so targeted, it is less complicated to certify for than various other alternatives. Because it covers the insured's whole life, costs are greater than a term life insurance coverage plan.

Read more about the different kinds of long-term life insurance policy below. While the policyholder is still alive, he or she can draw on the plan's cash money value.

The smart Trick of Paul B Insurance That Nobody is Talking About

The key difference is the insurance holder's capability to spend the plan's cash worth. Throughout all this, the insurance policy holder has to maintain a high adequate money worth to cover any policy costs.

On the flip side, the incomes from a high-return financial investment could cover some or all of the premium prices. One more benefit is that, unlike with the majority of policies, the cash worth of a variable plan can be contributed to the survivor benefit. Final expense life insurance, likewise called burial or funeral insurance coverage, is suggested to cover costs that will certainly be credited the insurance policy holder's family members or estate.

It is a specifically attractive option if one party has wellness concerns that make an individual policy unaffordable. It is much less typical than other types of long-term life insurance coverage.

The Main Principles Of Paul B Insurance

Often, they even save vacationers' lives. A couple of things you should learn about traveling insurance policy: Benefits vary by strategy. It is necessary to choose a strategy that fits your requirements, your budget as well as your traveling plans. Right here are definitions of all available traveling insurance policy benefits. Traveling insurance coverage can't cover every feasible circumstance.

Without travel insurance policy, you 'd lose the cash you invested on your getaway., which suggests you can be reimbursed for your pre paid, nonrefundable journey costs.

Terms, conditions and also exclusions apply. Advantages may not cover the complete cost of your loss. All advantages undergo maximum restrictions of obligation, which might in many cases undergo sublimits and day-to-day optimums. Allianz Global Help offers a series of traveling insurance prepares that consist of different advantages as well as advantage limits.

Paul B Insurance - Truths

When you enter your age, journey prices and journey days, we can advise a couple of strategies for you. You can compare the prices and also advantages of each. If you're a budget-conscious vacationer who's traveling in the united state, you might such as the One, Journey Cancellation Plus PlanIt includes trip termination, journey interruption and journey hold-up advantages.

This inexpensive plan consists of emergency situation medical and emergency situation transport advantages, in addition to other post-departure advantages, yet trip cancellation/interruption. If you want the discover this peace of mind of carrying considerable travel insurance coverage benefits, the most effective fit might be the One, Trip Prime Strategy. This plan also covers children 17 and under free of cost when taking a trip with a parent or grandparent.

It gives you economical security for a full year of traveling, including advantages for trip termination and interruption; emergency situation clinical treatment; lost/stolen or delayed baggage; as well as Rental Vehicle Burglary & Damages defense (readily available to homeowners of the majority of states). The best time to get traveling insurance coverage is instantly after you have actually completed your traveling setups.

The Facts About Paul B Insurance Revealed

You need to acquire your plan official source within 14 days of making your initial trip deposit in order her explanation to be eligible for the pre-existing clinical problem advantage (not available on all plans). If you're not completely satisfied with your plan, you have 15 days (or a lot more, depending upon your state of house) to ask for a refund, offered you have not started your trip or initiated a claim.

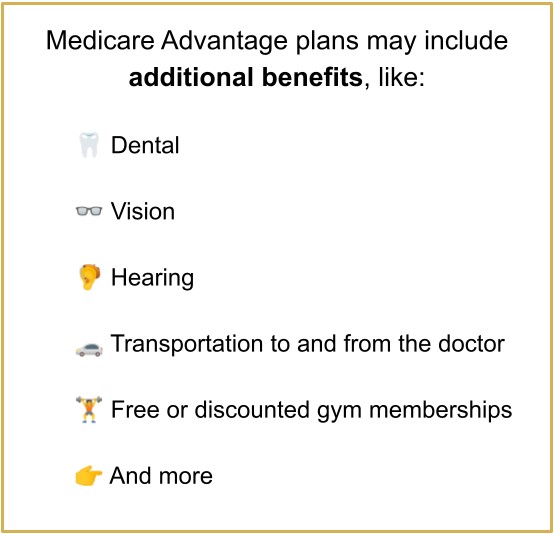

Plans may provide some additional advantages that Original Medicare doesn't cover like vision, hearing, and oral solutions. You sign up with a strategy supplied by Medicare-approved exclusive companies that comply with policies set by Medicare. Each plan can have different rules for how you get services, like needing referrals to see a professional.